New Delhi, April 8

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) has kept the benchmark repo and reverse repo rates unchanged for the twelfth consecutive time. The central bank also pared the GDP growth projection to 7.2 per cent for the current fiscal from 7.8 per cent estimated earlier due to rising crude oil prices and supply chain disruptions following the Russia-Ukraine war.

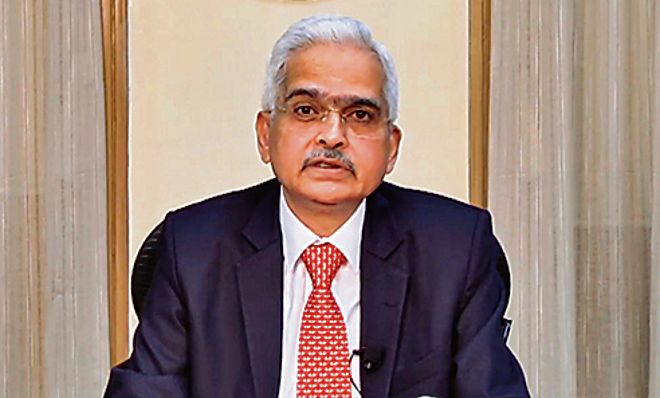

The MPC also decided to continue with an accommodative monetary policy stance, but the RBI will withdraw in phases the easy lending policies that have been the norm since the Covid pandemic struck. In his first bi-monthly monetary policy review of the current fiscal, RBI chief Shaktikanta Das assured that the Reserve Bank would prioritise the rising inflationary pressures. He expected the robust rabi crop to support the recovery in rural demand while a pick-up in contact-intensive services should help in further strengthening urban demand.

Das said the inflation target had also been revised upwards sharply to 5.7 per cent for the current fiscal due to the Russia-Ukraine war.

"In the sequence of priorities, we have now put inflation before growth. First is inflation, then is growth. For the last three years, starting February 2019, we have put growth ahead of inflation in the sequence," observed the RBI chief.

Domestic markets welcomed the accommodative stance with Nifty opening positive in line with its global peers. Broader market closed in green with Nifty Midcap 100 up one per cent and Nifty Smallcap 100 up 0.4 per cent.

"Overall, equity markets have shown strong resilience even though it faces headwinds from an uncertain global environment and persistent inflation," said Motilal Oswal Financial.

FICCI president Sanjiv Mehta said, "The continuation of RBI's accommodative stance is welcome."

Soon, card-less cash Withdrawal at all ATMs

The RBI has decided to permit all banks to introduce card-less cash withdrawal through ATMs. Currently, only a few banks offer the facility for own customers at their ATMs.

Rationalised home loan norms extended

Seeking to facilitate higher credit flow of individual housing loans, the RBI on Friday extended the rationalised home loan norms by another year till March 31, 2023. —