New Delhi, May 23

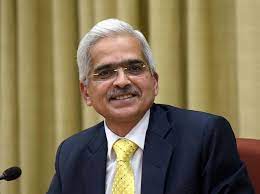

RBI Governor Shaktikanta Das on Monday hinted at another interest rate hike in early June to bring down high inflation which has remained above the tolerance level for the past four months. The next meeting of the RBI's Monetary Policy Committee (MPC) is scheduled for June 6-8. Though the partial excise duty cut on fuels will somewhat tame inflation by up to 40 basis points, the step is considered too inadequate in this regard.

It's a no-brainer

Expectation of rate hike, it's a no-brainer. There will be some hike but how much I will not be able to tell now. Shaktikanta Das, RBI Governor

"Expectation of rate hike, it's a no-brainer. There will be some hike but how much I will not be able to tell now," he said in an interview to a TV channel. The RBI on May 4 hiked the repo rate for the first time in nearly four years by 40 basis points to 4.40%. It has already upped its inflation forecast for 2022-23 to 5.7% from 4.5% and lowered its GDP estimate to 7.2% from 7.8% projected earlier.

Das said the RBI and government have entered into another phase of coordinated action to cool down inflation. The RBI has taken a number of steps to moderate inflation in the past two to three months and so had the government such as wheat export ban and cut in excise duty on fuel. These steps would have a sobering impact on the price rise, he hoped.

"We are enthused by the recent excise duty cut on petrol and diesel, which has been complemented by cut in VAT by some states. This will bolster sentiment and create some cushion within stretched household budgets to undertake non-essential spending," said rating agency ICRA's Aditi Nayar.

"Improving contact-intensive services amid revival in urban demand is driving personal consumption. The outlook for agriculture remains positive in the wake of normal southwest monsoon forecast for 2022, which would support rural consumption," said the RBI Governor. — TNS

Prolonged heatwave may hit growth: Moody's

Prolonged high temperatures are credit negative for India as it could exacerbate inflation and hurt growth, as per Moody's Investors Service