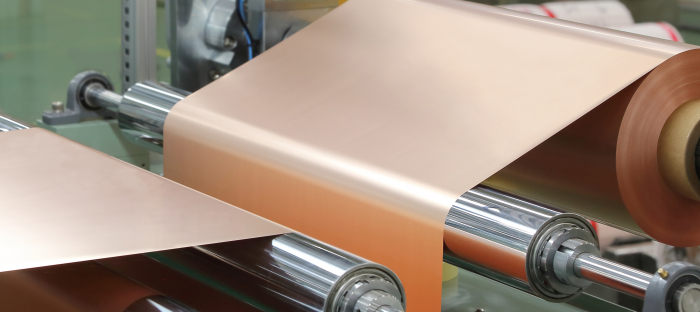

Iljin Materials is offering to sell a 53.3% stake held by CEO Heo Jae-Myeong Iljin Materials Co., a South Korean supplier of electric vehicle battery materials, has put a majority stake up for sale, which is estimated at around 3 trillion won ($2.4 billion) in value, or a 30% premium from its market price.The company recently hired Citigroup Global Markets as its sale manager and sent teaser letters to potential candidates, according to sources with knowledge of the matter on Tuesday.The chunk up for sale is a 53.3% stake held by its Chief Executive Heo Jae-Myeong, the second son of parent Iljin Group’s founder and Chairman Heo Jin-gyu. CEO Heo is the only shareholder with a stake over 5% in the producer of elecfoil, a thin copper foil used for cathode collectors in EV batteries.Industry watchers are scratching their heads over the planned stake sale by the world’s top copper foil maker for EV batteries, which is seeking to advance into other materials, including flexible copper-clad laminates (FCCLs) used for smartphones.It is participating in the bid for NexFlex Co., South Korea's largest manufacturer of FCCLs, while touted as a strong candidate for PI Advanced, the world's largest polyimide (PI) film manufacturer.Further, Iljin announced a plan last week to pour 500 billion won by 2024 into the first stage of investment in building its first Europe-based plant in Spain, as part of Volkswagen Group-led 70 billion euro ($73 billion) project to develop Spain into an EV hub in Europe. In response to this article, Iljin Materials said in a regulatory filing: “When asked about this news, our largest shareholder informed us that he is taking various strategic options into consideration, including a stake sale, but nothing has yet been determined.”Market speculation is that a family conflict might prompt CEO to put his entire stake in the company on the market.But some dismissed the rumors as unfounded since the group has already divided the group ownership between CEO Heo and his elder brother who controls three Iljin Group units. Heo, the second son, takes charge of four other units of the group, including Iljin Materials, as a key shareholder. “To keep up with the rapid growth of the EV battery market, its materials suppliers need to make heavy facility investment on a continuous basis, which Iljin might find difficult to afford as a medium-sized company," said a source familiar with Iljin Group.“The increased valuation driven by rising interest in EV batteries might have led the company to put the stake up for sale,” he told Market Insight, the capital market news provider of The Korea Economic Daily. Iljin Materials' 2021 operating profit surged 66% on-year, with sales up 45%

As a supplier of Swedish battery maker Northvolt, Iljin is planning to ship its products to Samsung SDI Co.’s plant in the US.

Iljin is the first South Korean company that produced copper foils used in printed circuit boards (PCBs) at home. A PCB connects chips to the circuit boards of electronic devices.As copper foil is now widely used in EV battery production, the materials supplier has grown as the world’s largest copper foil maker for EV batteries.Its consolidated operating profit surged 66% on-year to 21.6 billion won last year, with sales up 45% to 200 billion won. Its first-quarter operating profit came in 69.9 billion won on sales of 688.8 billion won.Buying the majority stake in Iljin Materials would mean securing its foreign and domestic clients, including EV battery makers, which could draw interest from top South Korean business groups such as Samsung, LG, SK, Lotte and POSCO.Its shares closed little changed at 93,900 won on Tuesday, versus a 1.57% drop in the broader Kospi index.By Chae-Yeon Kim and Byung-Keun Kimwhy29@hankyung.comYeonhee Kim edited this article.

Most Read