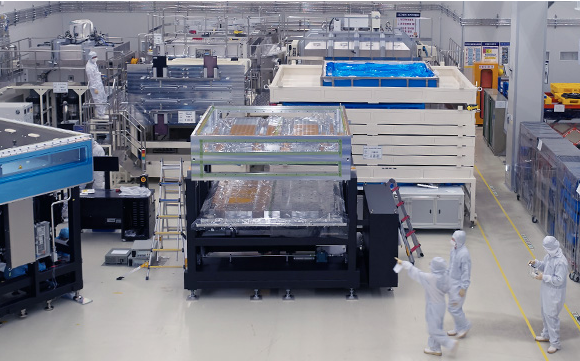

South Korean display equipment maker Wonik IPS’ display R&D center (Courtesy of Wonik) South Korea’s display equipment makers are suffering from the global supply disruption with forced delay shipments of products to clients, interrupting facility expansions of the local panel producers such as the world’s leader LG Display Co.Domestic display equipment makers have been unable to keep delivery dates as they could not procure key components from other countries on time due to the supply crisis, according to the Korea Display Industry Association (KDIA) on Tuesday.It was known for the delivery of core parts of organic light-emitting diode (OLED) panels to take more than six months after orders, far longer than two to three months in the past, according to industry sources. Display makers have to wait about one year to procure filters, which had been delivered in about two and half months.A South Korean equipment producer had no choice but to inform its key customer that it will have to delay the delivery of a machine to year-end from this month due to a severe disruption of parts procurements. The display maker had to postpone its plan to replace and expand production facilities.“An unprecedented series of collapses is destructing South Korea’s display industry,” said a source in the sector.Key equipment manufacturers such as Wonik IPS Co., Jusung Engineering Co. and Sunic System Ltd. failed to find substitutes within the country as foreign companies supply most components. Some equipment makers had to buy used parts from China for more than double the prices.“The global supply chain disruption revealed the disastrous reality of the local display equipment sector,” said another industry source said.ONLY 9% OF PARTS MADE IN KOREASouth Korean display equipment makers do not have both the technology and capabilities to produce their own parts to cope with the global supply disruption.Components made in the country accounted for only 9% of the domestic display equipment industry in 2021, showed a KDIA report obtained by The Korea Economic Daily. Parts from the US, Japan and Europe made up 37%, 29% and 19%, respectively, according to the first analysis of market share by country in the country’s display equipment sector. South Korea wholly relied on Taiwan for industrial PCs.Such heavy reliance on foreign components made the domestic equipment industry more vulnerable to global supply chain disruption.“It is impossible to meet a deadline with the delivery of a single core part delayed,” said a source from an equipment maker. “We are in an emergency since the procurement of some parts is postponed by up to one year.”The industry sees the disruption hurting exports of display equipment as it became hard to deliver products by due dates.HARD TO MAKE MONEYParts for display equipment need to be replaced by every six to 12 months, or up to five years. It is essential for equipment makers to stably procure high-quality components as they also provide after-sale services such as part replacements.Equipment makers, as well as display producers, have been seeking competitive local part manufacturers, but it was not easy as the parts sector is in severe conditions, industry sources said.Many component makers changed their businesses as it was hard to make money in the local industry, according to the sources.That raised equipment makers’ dependence on foreign parts.Turbo pumps, key components for the major five facilities to produce OLED displays, are not locally manufactured. South Korean equipment makers buy 40% of the pumps they need each from the UK and Japan, as well as 20% from Germany. The UK’s Edwards and Japan’s ULVAC Inc. are major suppliers to Wonik, Jusung and H&iruja Co.It takes six months to receive them after orders, nearly double of three and half months in the past.South Korea imports gas filters, which help gas flow smoothly by collecting alien substances running through pipes – 80% from the US and 20% from Japan. Their deliveries are delayed by eight and a half months to 11 months from the prior two and half months.O-rings, round-shaped rings that prevent gas leakage, are all supplied by the US. Equipment makers have to wait one year to receive them, which took about six months for delivery before.COOPERATIONConcerns deepened over the intensifying parts shortage as it was uncertain when the global supply disruption eases, while shipping costs surged.The KDIA is seeking cooperation between the equipment makers and parts producers by setting up a body to discuss development plans for the sectors. About 40 equipment and parts makers including Sunic and Enjet Inc. were known to plan to join the body.“No matter what the global supply chain situation is, it is urgent to improve parts competitiveness in order to minimize the damage to the industry,” said a KDIA official said. “Some urge to seek joint technology development and other efficiency measures as it needs a lot of time and money to develop equipment parts.”The improvement in parts competitiveness is expected to enhance the business of not only equipment makers but also display manufacturers, industry sources said.South Korean display equipment makers’ global sales shrank to $233 million last year, merely a tenth of $2.3 billion in 2020, according to market research firm Omdia. That was almost nothing compared to the $10.5 billion of Chinese competitors.By Ji-Eun Jeongjeong@hankyung.comJongwoo Cheon edited this article.

Most Read