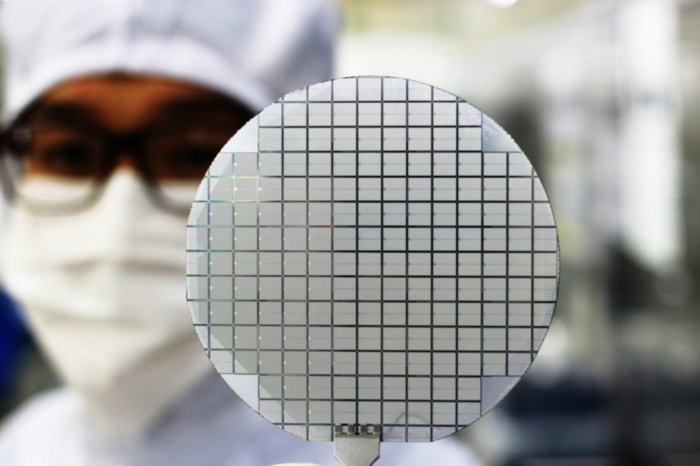

A Yes Powertechnix official shows a wafer that has completed the chip manufacturing process (Courtesy of SK Inc.) SK Group, South Korea’s third-largest conglomerate, geared up the development of the electric vehicle chip business with an acquisition of a local power semiconductor maker to expand its presence in one of the world’s fastest-growing industries.SK Inc. invested 120 billion won ($95 million) in Yes Powertechnix Co. to raise its stake in the silicon carbide (SiC) semiconductor producer to 95.8%, the SK Group’s holding company said on Wednesday.In January last year, SK bought a 33.6% stake in Yes Powertechnix for 26.8 billion, helping the company develop products, upgrade manufacturing processes and find customers.FAST-GROWING MARKETPower semiconductors, used for current directions and power conversions, are essential for EVs, electronics and 5G communication networks. SiC power semiconductors are in the spotlight as a next-generation product that withstands about 10 times of voltage of the existing semiconductors and high heats of hundreds of degrees with 10% thickness compared with the current models.SiC power semiconductors also improve EV energy efficiency by 7%, becoming a key component of the eco-friendly vehicles. About a third of EVs around the world have been equipped with the semiconductors since Tesla Inc., the world’s top EV maker, started using them for the Model 3 in 2018.The global SiC semiconductor market was forecast to grow to $4.9 billion in 2026, French market research and consulting firm Yole Developpement has expected. It continued to raise the forecast with more than 60% of EVs expected to use the semiconductors in 2025 on the growing demand for ultra-fast charging, which requires high voltages.The world’s SiC power semiconductor market is dominated by a few companies in Germany, the US and Japan. Yes Powertechnix has a technology for the 1,700V metal–oxide–semiconductor field-effect transistor (MOSFET), a semiconductor device for high-speed switching that controls the amount of current, to compete with global leaders.ANOTHER GROWTH OPPORTUNITYSK plans to take the lead in localizing Yes Powertechnix’s core technologies for SiC power semiconductors through continuous research and development while enhancing its technology competitiveness with capital expenditures.The takeover is expected to create various synergies as Yes Powertechnix will be able to secure a stable supply of SiC wafers through SK Siltron Co., SK’s silicon wafer subsidiary with the key material of the SiC power semiconductors currently in shortage of supply globally.“SK, which has been making pre-emptive investments in core EV technologies, secured another growth opportunity in the fast-growing SiC power semiconductor market through this investment,” said Kim Yang-taek, executive vice president of SK’s Advanced Materials Investment Center.“We will become a key EV semiconductor device company by upgrading SiC power semiconductor technology and establishing a global mass production system.”By Chae-Yeon Kimwhy29@hankyung.comJongwoo Cheon edited this article.

Most Read