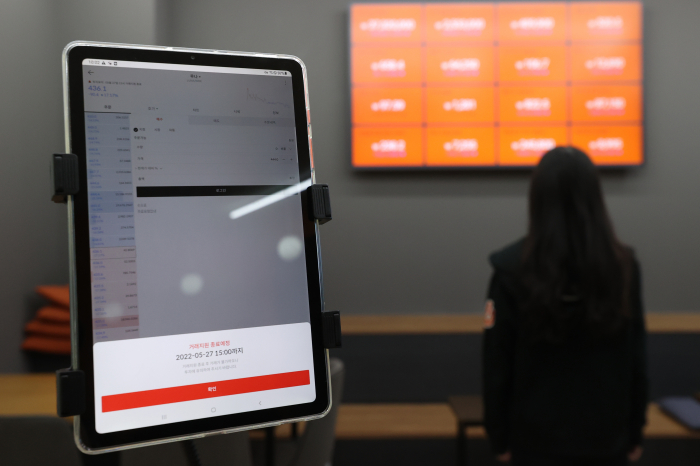

Crypto exchanges based in South Korea has deslited LUNA (now LUNC) and the linked stablecoin Terra (UST) last week. The price of LUNA 2.0 (LUNA), the brand new token by the controversial Terraform Labs Ltd., has been on a tumultuous ride since its launch a couple of days ago. The Singapore-based digital asset company launched the token in an effort to rescue the Terra ecosystem – following the collapse of Luna and the linked stablecoin dubbed Terra (UST,) which was supposed to be pegged to the US dollar. The old Luna is now rebranded as Luna Classic (LUNC) and Terra stablecoin as Terra Classic.The freshly-minted LUNA made its debut at $0.50 at 5 pm on May 28; and surged to $30 a token within 10 minutes of its launch on Bybit, a Singapore exchange. The trade volume for the rescue token shot up to a whopping $36.17 million in less than 24 hours. The bull run was short-lived, however, with the price plunging more than 80% within the next six hours. LUNA is currently trading between $5 - 6 per token. In addition to Bybit, LUNA is available for trade on the world’s largest crypto exchange Binance, as well as on Huobi Global, Gate.io, and OKX. Binance CEO Changpeng Zhao, commonly known as CZ, has been largely critical of the new token initiative.But when a large number of Binance users received LUNA 2.0 through an airdrop, the Cayman Islands-based exchange would have felt obliged to make it available for trade. AIRDROP OFF-SETS PRICE DROPAn airdrop is an unsolicited distribution of a crypto to numerous wallet addresses. The allocation is almost always free as its aim is to expand and energize the particular token’s ecosystem. Existing holders of the previous Luna token (LUNC) utilized the opportunity to divest the de facto worthless digital asset vis-a-vis the newer replacement at the exchanges that listed it.In South Korea, five domestic exchanges – namely Upbit, Bithumb, Coinone, Korbit and GOPAX – allow such airdrops. Screenshot of Terraform Labs CEO Do Kwon's tweet on May 26 Co-founder and CEO of Terraform Labs Do Kwon has been uncharacteristically active on his sole communications channel, Twitter, in the last few days to hype up the latest product. Kwon has been re-tweeting different exchanges’ announcements of their support for LUNA. In particular, he claimed that Terra 2.0 is on “fertile soil,” a play on words on Soil Protocol, an NFT infrastructure built for the Terra stablecoin.Brian Hoon-jong Paik, the Chief Operating Officer of crypto investment app Sandbank, criticized Terraform’s latest invention by saying the company has yet to indicate where and how LUNA will be used. HOME DISADVANTAGEExchanges in South Korea are not embracing the new initiative; but rather formed a joint response council with the aim of protecting investor interest. Through the council, the exchanges plan to standardize the measures in which they designate and categorize tokens that require investor discretion or delisting. The entrace of the financial crime investigation team within the Supreme Prosecutors’ Office in Seoul As of last Thursday, LUNA has been delisted on all exchanges based on the peninsula. Turning to the legal repercussions, the Supreme Prosecutors’ Office in Seoul summoned and investigated an unnamed former Terraform Labs’ developer as a witness. By Jin-Woo Parkjwp@hankyung.comJee Abbey Lee edited this article.

Most Read