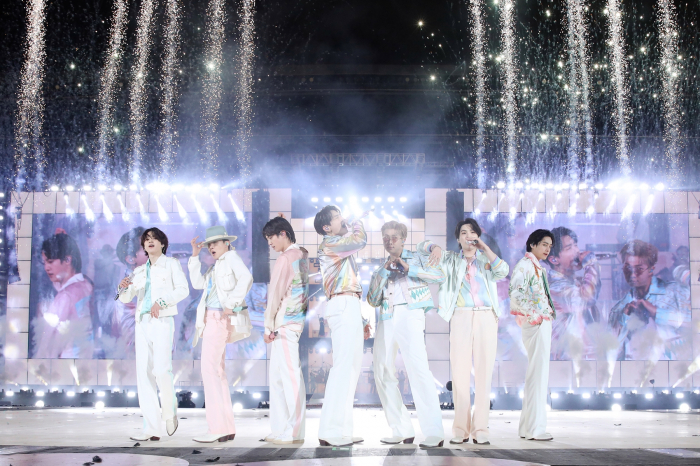

BTS concert in Seoul (Courtesy of Big Hit Music) South Korean entertainment stocks rallied as K-pop stars such as BTS and Twice return to the stage with the global economic reopening amid growing hopes for healthy earnings. The industry is also expected to gain momentum in new businesses such as metaverse this year for long-term growth.The share price of JYP Entertainment Inc., the management agency of a nine-member girl band Twice, rose 17.4% in a month to March 23, while YG Entertainment Inc., the label behind BlackPink, added 10.3%, far outperforming a 6.1% gain in the wider Kosdaq. Red Velvet’s SM Entertainment Co. advanced 5% and BTS’ HYBE Co. has increased 5.7%, during the period.Their stocks had been sluggish since late last year as the Omicron variant of the COVID-19 kept governments around the world from reopening their economies. The Federal Reserve also indicated the US central bank would tighten its monetary policy earlier than expected, hurting growth stocks including the South Korean entertainment names. HYBE had lost more than 40% from its peak, while its peers also tumbled about 30%.Those stocks, however, started showing signs of rebounds from early February as some of them reported better earnings than expected. JYP surprised investors with an operating profit of 16.3 billion won ($13.4 million) in the fourth quarter of 2021, 55.1% higher than a year earlier and 7.7% more than a market consensus. YG and HYBE also beat the market forecasts of their quarterly earnings.BACK ON STAGESuch surprising earnings came as their key artists sold more than 1 million albums, indicating changes in profit structures of entertainment companies, experts said.“Their earnings had been very volatile, depending on sales from concerts, in the past,” said Lee Han-Young, head of equity management office at DS Asset Management. “But rising sales of digital music titles and albums enhanced their fundamentals.”Governments around the world gradually reopened their economies, allowing major K-pop stars to resume physical concerts.BTS, the world’s top boy band, returned to the stage for three shows in Seoul earlier this month, while Twice started a concert tour in North America last month. Stray Kids, an eight-member boy band, and Seventeen are also scheduled to perform offline. Twice (Courtesy of JYP Entertainment) “Most concerts are held both online and offline at the same time,” said Ahn Jin-ah, an analyst at eBest Investment & Securities. “They will see rising sales of not only offline tickets but also online tickets, paid fan clubs and goods of artists.”RECORD EARNINGS EXPECTEDSouth Korea’s four major entertainment companies are expected to report their record profits this year, analysts said. YG’s operating profit was forecast to rise 62.6% in 2022, for example, according to market tracker FnGuide Inc. BlackPink “Album sales reported strong growth in January and February despite some concerns over a slowdown due to a base effect, given a record sales volume of 57.1 million last year,” said Ji In-hae, an analyst at Shinhan Investment Corp.Investors also hoped the industry’s new businesses related to intellectual properties (IPs) and metaverse will lead to growth in earnings for the long term, considering YouTube, which had been just a channel for advertising, became a key profit source.HYBE decided to launch non-fungible tokens (NFTs) for assets of BTS with Dunamu Inc., the operator of South Korea’s largest cryptocurrency exchange. The label also started creating webtoons and web novels in the current quarter with a plan to enter the game industry in the second. Its competitors are also actively working on new businesses linked to IPs and metaverse.Valuations of entertainment companies’ stocks are attractive. HYBE’s 12-month forward price-to-earnings ratio fell to 43.3 times from 57.2 times at the end-November, 2021.“Their shares may see some corrections due to recent surges,” DS Asset Management’s Lee said. “But they are likely to stay firm with demand for stocks that have risen less than others among the major four companies.”By Hyeong-Gyo Seoseogyo@hankyung.comJongwoo Cheon edited this article.

Most Read