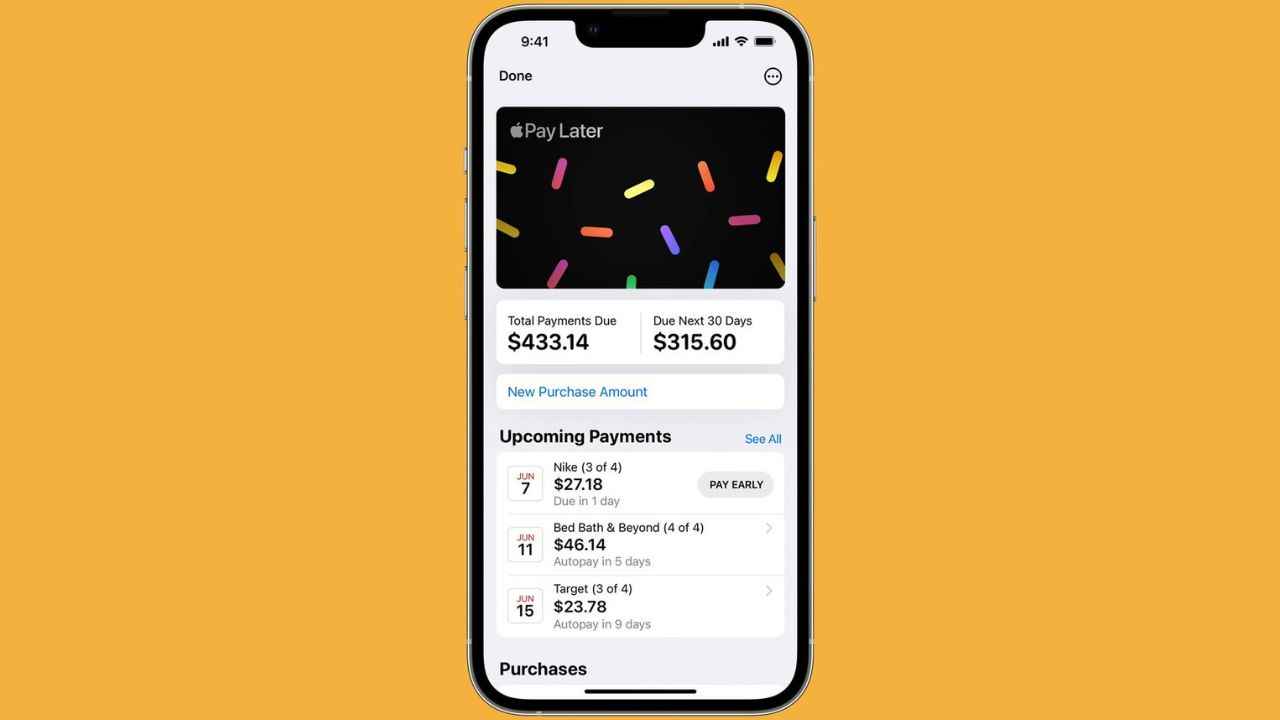

At WWDC (Worldwide Developers Conference) 2022, Apple unveiled the Pay Later service as part of the Apple Wallet in iOS 16. You would be able to use it on the iOS 16 stable release in the fall. As for the uninitiated who are wondering what is Apple Pay Later, it lets you purchase a product in four installments over a period of six weeks. So, it is Apple’s version of ‘Buy Now Pay Later’ concept. Here’s how you can use it:

How Apple Pay Later works?In Apple’s words, you would be able to “split the cost of your Apple Pay purchase into four payments over six weeks with no interest or fees”.

The only thing you need to keep in mind is that "A user's card-issuing bank may charge a fee if the user's debit card account contains insufficient funds". There don’t seem to be any late fees or processing fees for the moment in at least some of the Apple Pay Later plans. There won’t be even a credit check as per Bloomberg.

Eligible Apple customers can enrol in the service by submitting a local ID card copy via the Apple Wallet app on iPhone. You can register at the time of checking out a purchase with Apple Wallet or Apple Pay.

Apple Financing LLC manages the licensing and Goldman Sachs is affiliated with the new program as the issuer of the Apple Pay Later credential.

The payment, meanwhile, is directly linked as a virtual Mastercard in Apple Wallet to the user’s debit card.

Last but not least, Apple assures the safety and security of Keys and IDs involved in the Apple Pay Later payment process.

Is Apple Pay Later available in India?Apple Pay Later is initially rolling out in the United States only. So, it is not available in India for now. Let’s see what the future holds for us.

As for other news, reviews, feature stories, buying guides, and everything else tech-related, keep reading Digit.in.